Six Gold Bricks to Reaching Your Goals

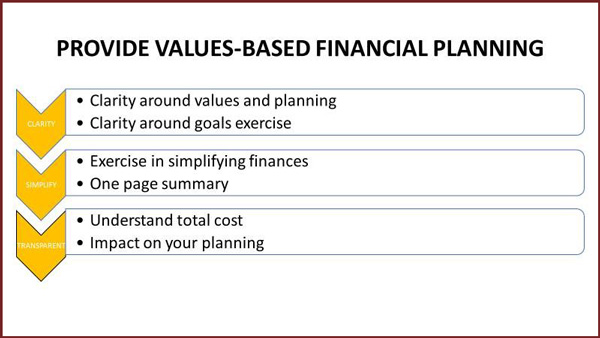

- Mapping all your goals & values on paper.

- Get your complete financial life in order.

- Total transparency - Fee Audit for current investments & Beneficiary Audit.

- GPS - Greater Probability of Success. What is the probability of reaching your goals?

- Are you aware of the Dietrich Professional Network? (We work with your accountants/lawyers to coordinate taxes, or our accounts/lawyers to coordinate your financial life.)

- Have you had a Legacy conversation?

Are You Receiving These Services From Your Financial Advisory Team?

What You Can Expect

-

A quality financial plan. Together we will complete a quality financial plan, a complete and thorough annual update of your comprehensive written lifetime financial strategy, updated to actualize your goals.

-

Progress update meetings and Implementation Strategy. Each time we meet, a straightforward, chronological list of simple action steps is provided to implement your financial plan along with a checklist of items to keep you on track. This process gives you a greater probability of accomplishing your long-term goals.

-

On Track progress reports. One page summaries of your complete financial life summarized for clarity, matched to your goals.

-

Goals Based Planning. We create a written plan for every client goal, to include specific accumulation and withdrawals requirements. We ensure you follow the plan and keep you on track. It's the accomplishment of your goals that is the proof that you have made the best decisions with your finances. This process will give you more "time", so you can focus on what's most important to you.

-

Best in Class Money Management. Our team will analyze how your assets are allocated, and give you advice on how to best position them to create the highest likelihood of achieving your goals. We will help provide "clarity" about your financial situation with a clear strategy going forward.

-

Asset Management Strategies. The most tax efficient and cost effective strategies suitable to your personal goals. A comprehensive checklist of money management strategies and due diligence is completed annually to ensure you are on track and we have the highest probability of success.

-

Income Tax Planning. Together, we will walk through a checklist of tax planning items to make sure every stone is uncovered to save you tax dollars. One of the best investments you can make is saving a dollar in tax, because it is a dollar thirty, or forty, or more. We will coordinate with your tax experts so you have two minds working on helping you save tax money, the best way possible.

-

Estate Planning. Our team will do a comprehensive review of your current estate plan. We will work with your Estate Planning legal professionals to implement any changes necessary. The two objectives are to establish a plan for your money to make it to the next generation and beyond according to their wishes and, secondly, to create a structure that will bring your heirs closer together, avoiding conflicts about the money after their demise. We help you put it on paper and clarify the future for next generations.

-

Cash & Debt Management. Together, we will estimate the short-term funds you need and how to establish and maintain those required short term funds. We will establish short and long term cash flow goals and give specific advice on how to reduce and/or eliminate any debts according to a timeline that makes sense.

-

Risk Management Planning. Our team will assess any risks we see in your future and uncover potential blind spots that may be a risk to your overall plans.

-

Time management. We will work with your professional advisors, accountants, lawyers risk managers (or refer our experts) and gather information and coordinate it so that it saves you time in completing your tax and estate planning. If we can save hours of time and help you get your total financial house in order, it will give you a higher probability of success.

-

Organization. We will help get your complete financial house in order and summarize it on one page. Helping you get and stay organized is our task, and we will create and manage documents online and on paper so that you have a complete view of your total financial house.

Outcome: Clarity around your financial future and a roadmap to follow.

Outcome: Getting and keeping on track.

Outcome: What gets measured gets managed. - Peter Drucker

Outcome: Clarity around ALL of your goals and a means of accomplishing more.

Outcome: Confidence.

Outcome: save more money and keep on track.

Outcome: Saving a dollar of tax is your best investment. Save more without working or affecting your spending.

Outcome: Peace of mind, confidence and measurable dollars.

Outcome: How to get more from the money you have.

Outcome: Peace of mind, confidence and measurable dollars.

Outcome: A Coordinated plan means bringing the different elements of (a complex activity or organization) into a relationship that will ensure efficiency or harmony.

Outcome: This will allow you more time to reach your goals.